Digital Business Insights research: What 1,595 Australian businesses do online

A new research report from Digital Business Insights reveals exactly what Australian Businesses are doing online and provides information to those businesses to ensure everyone maintains equal opportunity for an even playing field.

Why we need research

Perfect competition in a free market economy is dependent upon equal access to complete information. Success in such an economy is determined by what people do with the information they have. The more information that is available and the better skilled people are at processing that information, the greater their chances of success.

This is perhaps why the industry which occupies so much of my time is called “information technology”. The value of the technology is defined by its capacity to collect, store, distribute, and present information to the extent that it results in useful knowledge to achieve profit and a sustained competitive advantage. The faster the information changes, the greater the value the services of those who can help convert that information into success.

To assist with this process, research organisations collect and distribute information, often delivered hand in hand with a prescription that can be filled by those who collect the information. Recent examples include Jane McConnell’s Digital Workplace Trends report of 362 organisations around the world, Gartner’s survey of 2,053 CIOs in 36 industries across 41 countries, and Deloitte’s digital disruption map of 18 industries across Australia. Each exists to help business decide what to do next.

Digital Business Insights (DBi) is one such organisation that focuses on providing research-driven information with a focus on Australian business. DBi recently released their Q4-2012 survey results of the digital attitudes and behaviors from 1,595 businesses across Australia.

Finding what is common

The research report opens with:

What do all businesses in Australia have in common in their use of ICT? Nothing.

While it may be true that all entities use ICT differently, what is common is the internal business drivers and external market pressures that push business towards implementation of ICT-related services. Internal business drivers can nearly always be grouped into two outcomes: reduced cost and/or increased revenue, in a proportion that results in increased profit. This profit is universal to all types of organisations, defined in net positive results of financial, human, and social capital.

Two external challenges faces by organisations is the rate of change and market forces contributing to that change. The DBi research identifies these external forces to include:

- Greater access to information through open online networks;

- Globalisation shifting power from nations to corporations;

- Convergence of technology for anywhere, anytime access;

- New skills required from today’s workers; and

- Technology as a facilitator of collaborative business relationships and a moderator of autocratic business approaches

The report also identifies four broad areas of opportunities of IP telephony (e.g., NBN), mobility, the “new customer” (social, CRM), and value of a reliable IT platform. These opportunities need to be considered with other main influencing factors as Gartner’s refers to as the “nexus of forces” of mobility, information, social, and cloud. When business challenges and opportunities seem to swirl around like a tornado, it is important to have an understanding from which general direction the winds blow for you, your customers, and your competitors.

A sample of the results

The report covers a lot of information and is available for free download, so I will only touch on a few areas here.

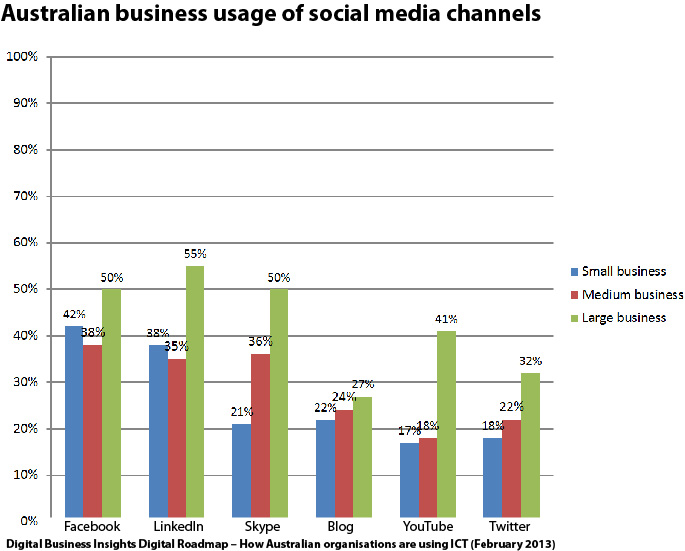

Use of social

There is little variance between small and medium businesses in the dominant channels of Facebook, LinkedIn and Twitter, while larger organisations have increased use of social channels. This is likely due to a need necessitated by a larger customer base and being able to afford internal resources to manage those channels. In smaller businesses where the operations manager doubles as the marketing manager and the CEO’s wife, allocating resources towards social channels may be limited.

In comparison to larger organisations, smaller businesses have a greater propensity to have a blog. Blogs can be a one-and-only online representation and can also position a company as an industry leader. I wonder how many smaller organisations have a blog as their primary communication channel, while larger organisations have other marketing channels that may be more effective in achieving what a blog does for smaller organisations.

I would be very curious as to how social media use differs by industry. I expect the usage between predominantly business to business versus business to consumer industries would differ significantly.

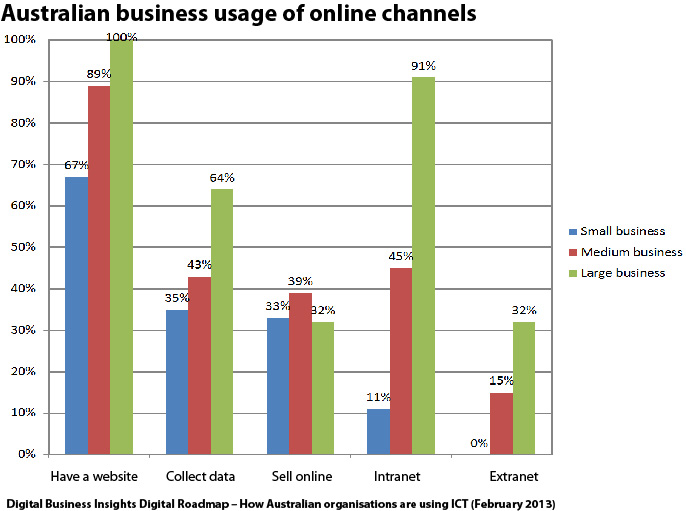

Online presence

Large businesses indicated they were more active in all measures of online activity except for selling online. It is not surprising that the same proportion of large businesses indicted they have an extranet. The distinction between an online shopping experience and an extranet can blur when you consider being able to log into an account, order based on credits, and view and manage order history.

An intranet of some sort is critical for larger organisations to manage the complexity of communication between so many people, more so than even collecting data online. Again curious at the cross section of data, I would be interested in the characteristics of companies that are active across all channels as compared to companies that participate in only one or two channels.

Self-rating of technology adoption

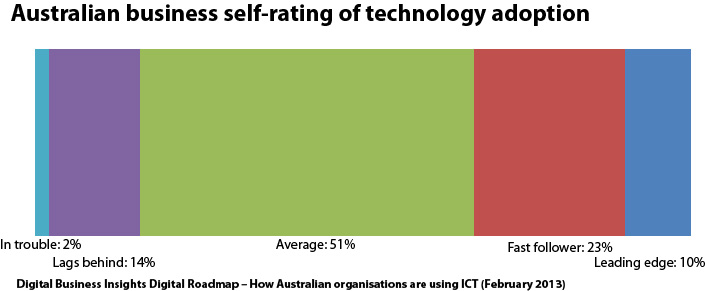

The extent that a company is active in the different channels above may contribute to whether the company considers themselves to be leading edge, fast followers, average, lagging behind, or in trouble with respect to their technology adoption. These are subjective and relative assessments, in that one industry may have a company that is leading the way and making other companies feel like they are lagging, while other industries may consider having email to be the above the standard.

Over half the companies consider themselves to be average at technology adoption, which at least speaks to a balanced self-perception. The media celebrates the 10 percent that identify themselves as leaders and those companies may benefit from first-mover advantage, but I will attest that it is an expensive proposition. For example, building iPhone and Android applications now are much easier as compared to a few years ago when the underlying operating systems were much less mature and there was a lack of a collective industry knowledge.

The sweet spot may be in the 23 percent of fast followers, letting the leaders blaze the trail, prove the technology and educate the masses while staying ahead of the average. While lagging behind and being “in trouble” can be criticized, those companies can represent the greatest potential. A company can quickly move from a laggard position to be a fast follower with a significant investment because that investment can have a quick return on investment. A caveat to this jump is that such a leap can require a drastic change in culture, internal process, and even leadership skill sets.

Pass it on

I am looking forward to future editions of the research that will provide greater direction to industry segments, facilitate collaborative mentoring relationships between businesses and industry bodies, and guide digital strategies that result in cost savings and revenue growth.

Perfect competition requires perfect information, freely accessible and easily shared. Free research outcomes such as the DBi results can be seen then to provide a piece of perfection in our imperfect world.

Please feel free to pass this information on and do your part in making the world a perfect place.