Reflections from a tour of regional Queensland innovation ecosystems

I recently toured regional innovation ecosystems in Queensland to better understand how entrepreneurs can be supported in regions. As we pause for the end of year, I take the opportunity to capture a few personal reflections before heading into 2019.

Genchi Genbutsu – “Go and see”

An innovation ecosystem is more than a model or logos on a screen. The innovation ecosystem is about the people and relationships in a region that work together to help entrepreneurs build, grow, and scale their business.

Over the past few years I have been on a journey to understand how these relationships work and what a region can do to make the system more effective. The best way to do this is to go and see, to hear the stories first hand.

I recently hit the road on the first stage of a national tour to understand and document the Australian innovation ecosystem. While the term “innovation ecosystem” can be open for debate, the scope I am using is specific to those who support early-stage, high growth potential entrepreneurs.

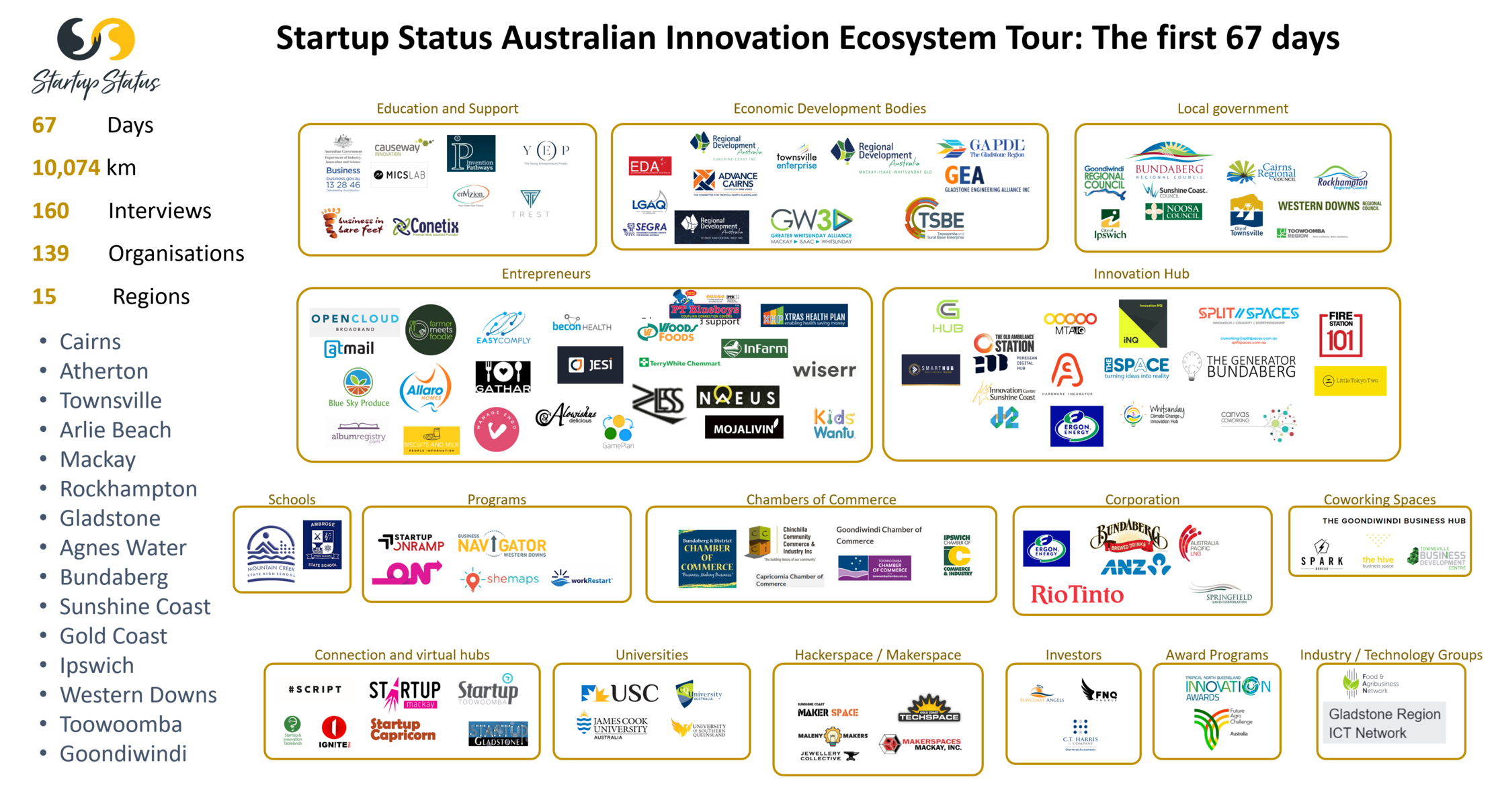

The tour saw me on the road for 67 days, covering 10,000 km across 15 regions in Queensland, and 160 interviews with 139 organisations. I spoke to organisations including:

- economic development bodies (12),

- local and federal government agencies (10),

- entrepreneurs (24),

- innovation hubs (17),

- coworking spaces (3),

- high schools and primary schools (2),

- universities (4),

- education and support providers, accelerator and award programs (16),

- chambers of commerce (6),

- corporations (6),

- investor groups (3),

- industry / technology groups (2), and

- makerspaces (5).

Part of the tour is research for a PhD asking the question “What is the role of an innovation hub in building resilience in regional communities?” The innovation hub is used as a central actor because it can be a nexus for activity, although others can fulfil similar functions as a hub. Through the tour, I ask questions of each group about what is working, challenges, best possible outcomes, and what needs to happen to realise success in the region for entrepreneurs.

The plan is to look at the data from different perspectives, including by role (local governments, chambers of commerce, innovation practitioners), by region, and by specific focus (sector, technology, or social impact area). This information can be used to develop principles that can help with decision making, develop public maps for collaboration and awareness, and build on global research.

Why now and why me?

My recent journey up to this point started when I managed a local government innovation hub for 18 months from the start of 2016. I began to question the effectiveness of the model compared to other models such as university, corporate, or independent hubs. I also traveled to other regions to consider other groups who have been playing a role in supporting new business for decades, but often without specialised services targeted at early-stage entrepreneur leveraging new technologies with high-growth potential and large market opportunities.

What is different about these “startup founders” that warrants special attention? They can seem to sit outside traditional economic development services in regional areas. Their global business models mean they are not attached to a specific region, can attract revenue and investment from outside the region, and often employ and engage services predominantly outside the region. Founders move towards the path of least resistance and greatest opportunity to validate and grow their business, attracted to regions with greater density of support and customers. Regions on the other hand try to attract and retain creative industries and knowledge sectors to build local capability.

As I moved on from the innovation hub to work with the Office of the Queensland Chief Entrepreneur, I continued to consider how to effectively map and support local systems that support high-growth entrepreneurs. My travels across the state collecting startup data raised more questions.

What is the best policy position and involvement of local government to support entrepreneurs? What role does the local university play? How do regions develop technical and entrepreneurial talent? How should local small business and chambers of commerce be involved? When does local investment step in and how?

And how does this vary for different types of regions? The regional versus non-metro debate is often seen as an either / or argument. In reality, different types of regions are diverse, including lifestyle, resource-based, remote, industrial corridor, and more.

It can be difficult to see a system when you are part of the system. So I left the government contract role in late 2018 to hit the road and gain another perspective.

The mechanics of the tour

The initial plan for the tour was a clean, structured loop around Queensland. I would start in Ipswich where I live, head out west, up north inland, then continue to the top of Cairns and surrounding remote areas before heading back down the coast.

The reality looked quite different, with a bit of back-tracking and jumping round. A few speaking engagements up the coast meant I aligned my visits with the conference dates for my talks. This resulted in starting in the Sunshine Coast, then up to Rockhampton and Mackay, and then backtrack down to Brisbane, out to Ipswich, and then west.

I started early October, and it was early November by the time I was out west and considering driving up to Longreach. By the end of October, the temperature was in the 40s (degrees Celsius) and many people were hunkering down to look after livestock in the heat. Not the best time perhaps to have someone asking about support for entrepreneurs, not to mention a lack of air conditioning in my car. We decided to change plans and postpone the visit inland until March to coincide with other events.

So I retraced my route up north along the coast and continued to Cairns before making my way back down south through November and December. The weather in Australia needs to planned for, particularly the wet and fire season over summer. The last week day of the tour, there were 138 fires across Queensland under a fire rating of “catastrophic” and I drove out from Bundaberg on my final day as ex-cyclone Owen dropped water across the state.

There is usually a single point of contact in the region who provides contact lists, warm introductions, and even schedules meetings which is a great help. The first interview starts opening up the region as I expand the networks of people in the community. The aim is to go beyond the primary contact to gain different perspectives and avoid group think form a single network. A given day may see 5 to 8 interviews and a workshop across 12+ hour days to fit as much as possible in the brief time I have in the community before moving on.

Qualitative stories are reviewed against data related to each individual where available. For example, how do factors relates such as the size of a local government economic development team, the region’s population or density levels, the structure and memberships of local innovation hubs, the member-base of the Chamber of Commerce, the programs available from the local university branch, the activity from the local makerspace, or the investment in the regions and stage of entrepreneurs?

It still feels as though we are only scratching the surface. There are over 15 types of roles identified in an innovation ecosystem, and many other individuals who don’t fit into a role but provide valuable support functions. Interviewing one person in an organisation may not represent the complete perspective of an organisation.

A consideration is whether to deep dive in a few locations or apply a broad review across many regions. We have gone with a broad review given the significant differences between regions and a desire to look for common principles that can be shared more broadly.

Another ideal that had to be set aside was the notion of lining up interviews well in advance. Opportunities emerge and not everyone is available at the times I am in the regions. There can be a bit of back-tracking to catch up with people to accommodate schedules, and side tracks into unplanned regions when you hear about new opportunities.

The summer heat and holiday season placed an urgency on the schedule, but more time is needed to create space between regions. The eventual goal is around 67 regions across Australia, but this will need to be spread out. The team and schedule will need to be increased to allow time to process the results, share outcomes on social media, and document as I go.

Initial thoughts and next steps

There is too much information to do justice to any list of lists like “5 things that need to change”. The best I can offer is some initial top of mind reflections:

1. Use of language is important

The innovation sector has its own language, which can be exclusive and may not be serving our communities well. Innovation hubs, hackathons, and startups can be seen in opposition and competition to traditional business support systems.

I found I used the term “startup” less in regional areas. Using language like “early stage, high growth potential business” may not be as exciting, but it helped when speaking with support groups who used the term to refer to new cafes and service agencies. Language such as “early stage, high growth potential economic development supply chain” will not attract a cult following like “innovation ecosystem“, but that may not be such a bad thing.

2. Engage all business

Some of the best businesses I spoke with came out of an established 20-year background in their sector. An established small business will create a new technology, leverage existing networks, and pop out a new brand and ABN. Instant startup.

Existing small businesses and corporations have muscle memory in hiring staff, managing profit and loss, and establishing sales. They know how to “adult” in the business world. There are opportunities to better integrate the innovation narrative with traditional business networks.

3. Resilience may not be the right term

I initially set out to consider resilience to market impacts in the same context as physical disruptions such as fires or floods. In a fire for flood, resilient communities have the capacity and capability to return the community to what was before.

Yet resilience may also infer a protection of status quo and resilience to change. The very mechanisms that protect a region, such as buy local campaigns, regulations, an emphasis on knowing someone for a long time, and protection of established industries, may make it difficult for new beneficial networks to gain a foothold. A new term may be needed to describe a region’s capability and capacity to try new things and be accepting of new opportunities. A “wait and see” approach to new innovation networks and startups will see those opportunities wither on the vine or leave for more accepting markets.

Next steps

The next steps are to transcribe and theme the interview content, compare against previous research, and document outcomes for the thesis. The Queensland loop will be used for the PhD, develop frameworks, and identify opportunities to collaborate as we head south into New South Wales and the rest of Australia between the second and third quarter of 2019.

I will continue to publish snippets as I go, and look forward to collaborating with others contributing to the field. I am grateful to those who hosted me on the journey and feedback provided. Community development is a community activity, and I would not be here if not for the community that has supported me along the way.

To keep informed on the journey, sign up for the Startup Status newsletter and connect with me on LinkedIn.