The Australian creative industry innovation ecosystem – a sample and snapshot

The ultimate intellectual property – the one that really replaces land, labour, and capital as the most valuable economic resource – is the human creative faculty. – Richard Florida, The Rise of the Creative Class

The relationship between the “creative class” and innovation outcomes is well established. The creative class is typically related to technology, programming, ICT-related disciplines, known as “knowledge workers”. This class performs work in the “creative industries” and plays a critical role in developing innovation in regions.

Before we continue, I am writing this because a friend of mine Philippe asked me to share about the upcoming intake for the QUT Collider creative industries accelerator. If you are creating a new company or technology related to the creative industries, you may want to consider applying. They are good people.

Philippe’s request last week bounced around with thoughts from a recent tour of the exceptional Sydney creative industries hub The Studio and a press release about Brisbane-based investment and innovation hub Mawson focusing on entertainment and artificial intelligence (paywall).

This prompted me to consider the interaction between creative industries as part of my current Australian research project, and update the Startup Status innovation map for actors in the creative industries.

Valuing creative industries in Australia

A good overview of creative industries impact and value in Australia is outlined in the 2015 book Creative Business in Australia: Learnings from the Creative Industries Innovation Centre, 2009-2015. The field of creative industries often refers to:

- architecture

- advertising and marketing

- software development and interactive content

- music and performing arts

- design and visual arts

- writing, publishing and print media

- film, television and radio

The book estimates both the direct and the indirect (or flow on, stimuli) contributions of the creative economy to the broader Australian economy to be around $90.19 billion annually, including contribution to GDP ($45.89 billion) and exports ($3.2B).

The creative industry sector is important to lifestyle and GDP. It would be tempting to conduct a quick scan of Richard Florida’s premise in his Rise of the Creative Class and bring in a few artists, authors, and programers to fix an economically ailing local economy.

However, the creative industries alone are unable to produce local growth and development. Putting a bunch or artists together will not create jobs. I reflects on my own experience in engaging with regional artist communities and the tension between artistic creativity and an entrepreneurial mandate.

This missing element was referred to in a recent study of 103 Italian provinces from 2006 to 2015 (Do the creative industries support growth and innovation in the wider economy? Industry relatedness and employment growth in Italy, Innocenti & Lazzeretti, 2019).

The research found that the creative class requires alignment with the wider non-related ecosystem actors as well as clustering with other creative industry actors to foster employment growth:

The mere clustering of creative workers in a context in which the rest of the workers are poorly connected to them is not sufficient to promote cross-connections and thus increases the innovation performance of the area. It is through cross-connections between creative and non-creative industries that is favoured innovation in related manufacturing and service sectors and thus contributing to growth.

To connect creative expression with commercial and entrepreneurial outcomes, we need an ecosystem.

The Australian creative industries innovation ecosystem

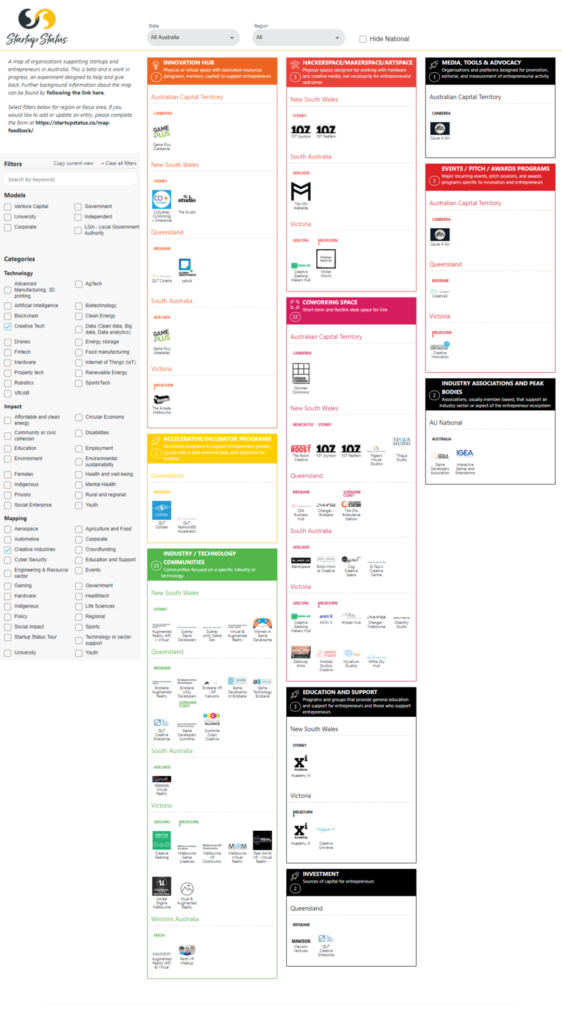

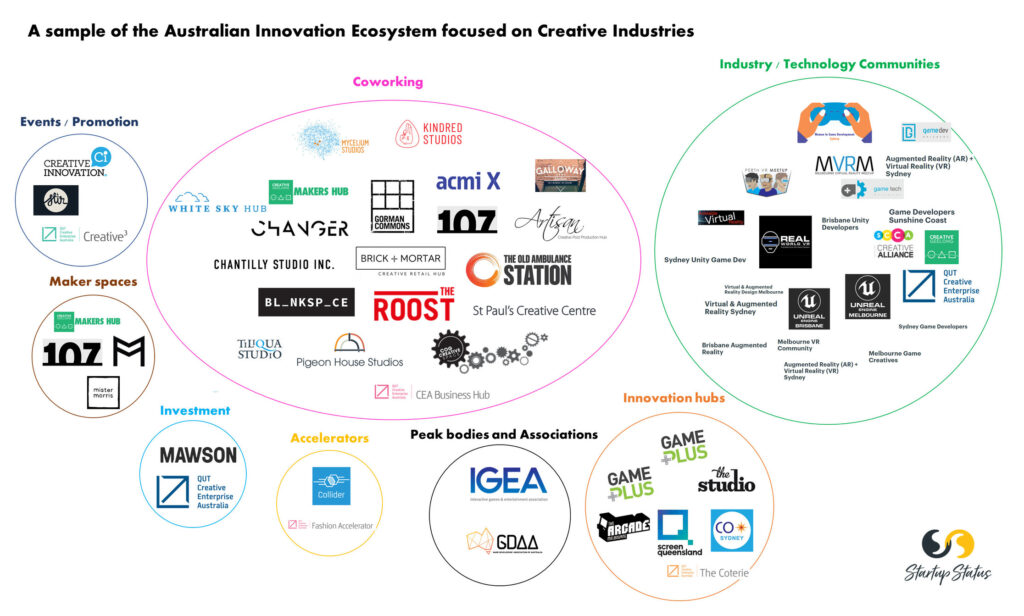

The Startup Status map identifies those who support early-stage, high growth potential entrepreneurs. The map filtered for creative industries can be found here. The filters applied include technology of Creative Tech and a mapping category of Creative Industries.

Some caveats apply:

- Creative industries is a broad term, and includes everything from art galleries to publishing houses. The map restricts this group to those who closely align with supporting early-stage, high growth potential initiatives.

- The innovation ecosystem in its entirety could be considered as relating to creative industries. The purpose of this post is to emphasise actors who support creative industries as a sector, such as gaming, art, music, etc. A similar project could (and will) be done for focus areas such as agriculture, health, social impact, or technology such as blockchain.

- Universities offer creative industry degrees and are inherently part of the creative industries pipeline. Universities are not categorised as creative industries unless they have a special purpose body or long-standing program specific to the creative industries, such as QUT’s Creative Enterprises Australia portfolio. I have not fully audited all universities, additional programs are welcome.

- Many coworking spaces identify as being creative, or supporting creatives. Spaces tagged on the map have a specific focus on the creative industries beyond just a green screen or recording studio. While some have been visited, this is based on a web review and subject to interpretation.

- This is not complete but is aiming for comprehensive. The map is a continuous work in progress and we most certainly missed someone to our embarrassment. If an actor is missing or needs correcting, please provide feedback here. There are also feedback links for each actor direct in the map in each actor’s profile.

- The map will be the final source for accurate listing and links, rather than this article. The commentary below is an explanation of the types of actors and will be out of date as soon as the first person provides feedback, usually ten minutes after this is published.

An overview of the mapping approach and taxonomy is here: A map of the Australian Innovation Ecosystem 2.0.

With the caveates above in mind, some further comments on individual actors.

Innovation hubs

Innovation provide evidence of specific programs and focus for creative industry entrepreneurs. General examples include The Studio, QUT Coterie, and Co-Sydney. Others focus on verticales – film with SQ Hub, video games at Game Plus and The Arcade Melbourne.

Coworking spaces

Coworking spaces in the list have an emphasis on supporting those in the creative industries and apparent potential for alignment to entrepreneurial outcomes. We look for more than a recording studio as an activation space, as these are becoming standard practice to support the growing media and self-promotion requirements of today’s entrepreneurs.

Examples include theatre stages, makerspaces, and digital post-production integrated in the one location (The Old Ambulance Station, Kindred Studios Creative Spaces). Other examples include spaces targeting a specific creative industries segment such as film making (Chantilly Studio), photography (Cog Creative Space) or music (White Sky Hub).

The refinement is based on an online review of over 350 coworking spaces in Australia and visiting several in that list. There are likely a few spaces that would make the case to be included, and perhaps others on the list that may not agree with the category. This is the reason why the map is dynamic and easy to change. Feedback is welcome.

Hackerspaces / Makerspaces / Artspaces

Hackerspaces are inherently creative, but some describe an emphasis on the creative industry process. While many makerspaces focus on the hardware, spaces such as The Mill Adelaide provides a clear description of a space in this category, offering “residencies, masterclasses, workshops, awards and opportunities to create new work, always promoting sustainable career pathways for artists. The Mill’s Angas Street (physical) space and adjacent program form an incubator that supports collaborative creative practice.“

The distinction between a coworking space and makerspace / artspace is support and encouragement of creating physical assets, often involving unique space requirements such as painting or pottery, as part of the residency.

Education and support

The education and support segment is under-represented on the map. Many universities could be in this segment, as well as training providers such as Tafe. Academy Xi is included as an example of a provider of specialist mixed media training, and Melbourne’s Creative Universe offers system-level support to go with their portfolio of programs, services, and events.

Investment

The are over 155 Australian investment groups identified as supporting early-stage, high growth potential companies. Some of these may have a specific mandate for creative industries, and others may have a broad portfolio that allows or encourages creative industry-related investments.

That said, the QUT Creative Enterprise Australia Startup Fund is exclusively designed for the creative industries sector. Mawson Ventures has recently focused their attention. The company previously described themselves as “Mawson is an Australian tech ventures firm that invests in AI, robotics, materials and renewable energy. We love simple, creative ideas with global appeal “.

This has changed to focus on the creative industries. Mawson’s tagline is “Creative intelligence…” with a position that “Mawson is a software lab exploring the frontiers of Deep Learning and Entertainment. We transform creative ideas into tomorrow’s leading tech startups.”

Media, Tools, Advocacy

There are many platforms and media tools available for startups and business in general. An example of a creative industries-specific platform includes Canberra-based Cause-a-stir. The platform is designed to transform talent into venture concepts, helping artists engage with the economy in a meaningful and rewarding way.

Events, pitch, award programs

Events specific to the cross-section of creative industries and innovation. QUT CEA’s Creative3 is the primary event in Australia specific to creative industries. Again, creative industries has representation in many of the annual startup or innovation festivals. Other events such as as Melbourne-based Creative Innovation also include creative industry as a concept, but are not exclusive to the sector.

Accelerators / Incubators

There are over 110 active accelerators in Australia at any given time, although these are the most dynamic of the actors. Programs are not always renewed, shift their focus, and new programs emerge.

Programs that have been pervasive and continue to grow are both with QUT CEA: Collider accelerator and the Fashion360 accelerator in Queensland and Foundry658 and ACMI Xcel in Melbourne.

Industry / Technology communities

This is another category open to interpretation and prone to under-representation on the map.

QUT CEA is listed here as a distinct community, but could also be considered a stand-alone virtual hub. Creative Geelong and Sunshine Coast Alliance are two local groups driving the combined creative industries and innovation narrative in their regions. The other groups listed here are based on a brief audit of meetup for communities involving game or mixed digital media.

Industry bodies

The scope for industry bodies in Australia is large. Many peak bodies exist for specific creative functions, such as museums, publishers, artists, etc. Two peak bodies included in this list are related to the video game industry: Game Developer Association of Australia (GDAA) and Interactive Games and Entertainment (IGEA).

Feedback welcome, and get involved

The Startup Status mapping project is an experiment designed to create a definitive view on the Australian support landscape for early-stage, high-growth potential entrepreneurs. The aim of this not-for-profit project is to democratise the information and reduce the transaction cost of passing information so we can focus more on relationships and execution.

In addition, and to provide greater value to the ecosystem, each hub on the map has the ability to: maintain their profile, manage and engage with entrepreneurs they are supporting, and measure the impact of their programs. We are currently providing access to hubs and programs in beta. Please contact me if you are a hub and would like to know more.

The creative industries sector is a critical part of the Australian innovation ecosystem. As reflected in the map, sector specialisation is being seen in regions across Australia. Your feedback on what is missing, comments on your experience with the value of the sector, and sharing with others you feel might benefit or add insights is most appreciated.